Tradefora

PLC — innovative best execution software development provider and

Advanced Markets Group, a leading Prime of Prime Liquidity Provider,

which is authorized and regulated by the Australian Securities and

Investments Commission (ASIC) and the Financial Conduct Authority (FCA)

is pleased to announce its new partnership. Founded in 2016 Tradefora

PLC is a fast growing FinTech company specializing on best execution,

TCA and regulatory reporting services for brokers, traders and

regulators.

Advanced Markets Group consists of Advanced

Markets LLC, Advanced Markets Ltd and Advanced Markets (UK) Ltd, and

provides trade execution and superior solutions to banks, hedge funds,

commodity trading advisors, corporations and other institutional market

participants.

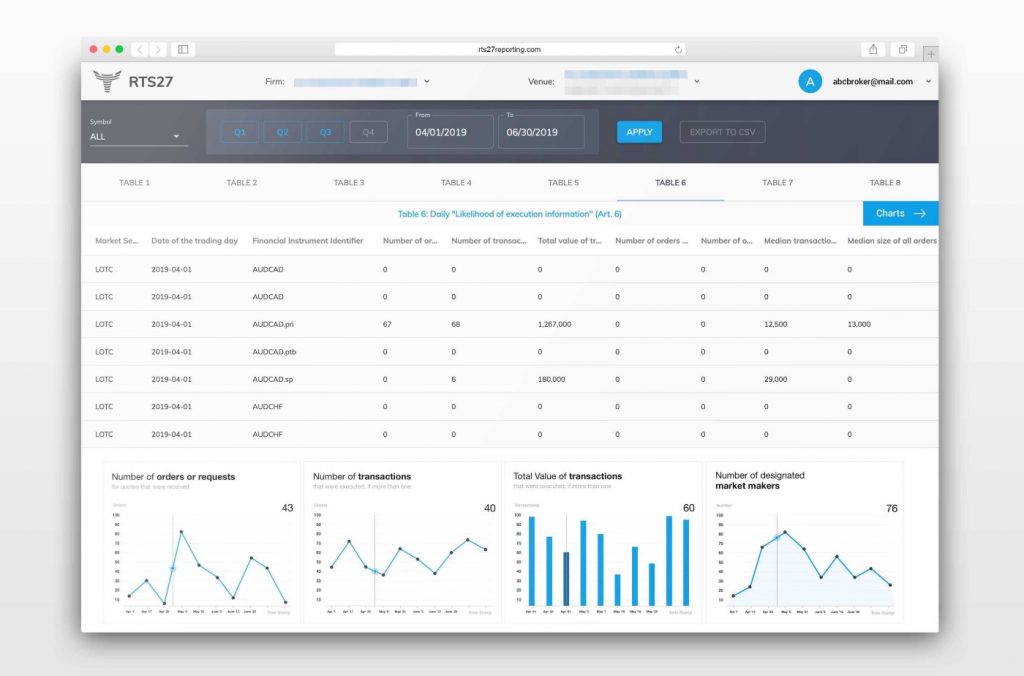

MiFID II requirements for mandatory publishing of best execution report (RTS 27) and top 5 execution venue reports (RTS 28) have been propelled to the forefront of compliance worries for many brokers operating in the EU during the last year. However, to this day seemingly straightforward reports turned out to be quite a technological challenge for many market participants. Mostly due to the fact that some of the reporting tables require brokers to store all of their tick data and use a 3rd party pricing benchmark feed to reference the quality of execution.

This reporting becomes especially complex when a broker is using multiple LPs with thousands of trading instruments, 10+ levels of market depth and high institutional level refresh rates. The data costs alone can be daunting, not to mention setting up the required reporting infrastructure if done in-house.

Pavel Khizhnyak, Co-Founder and CEO of Tradefora, commented:

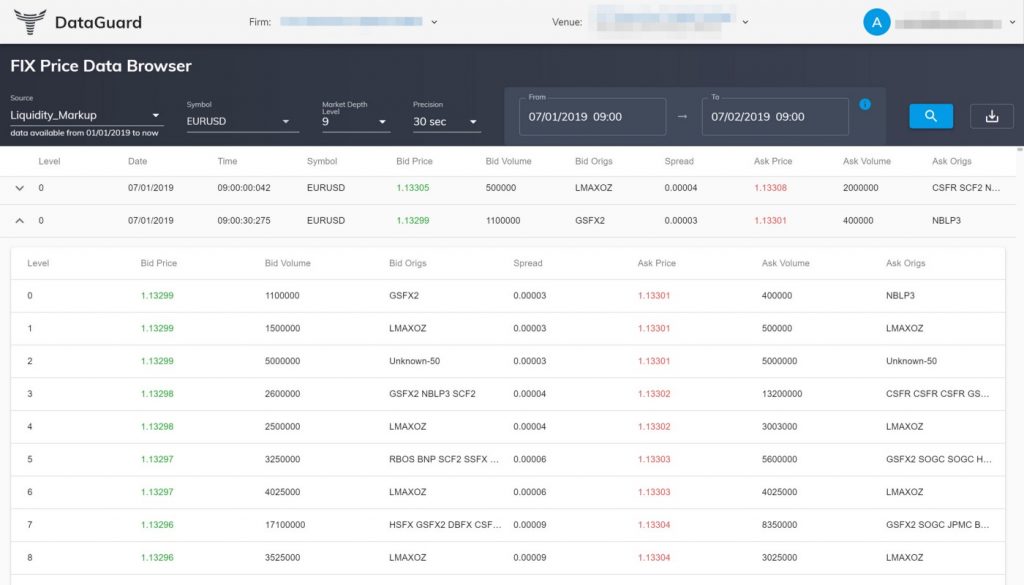

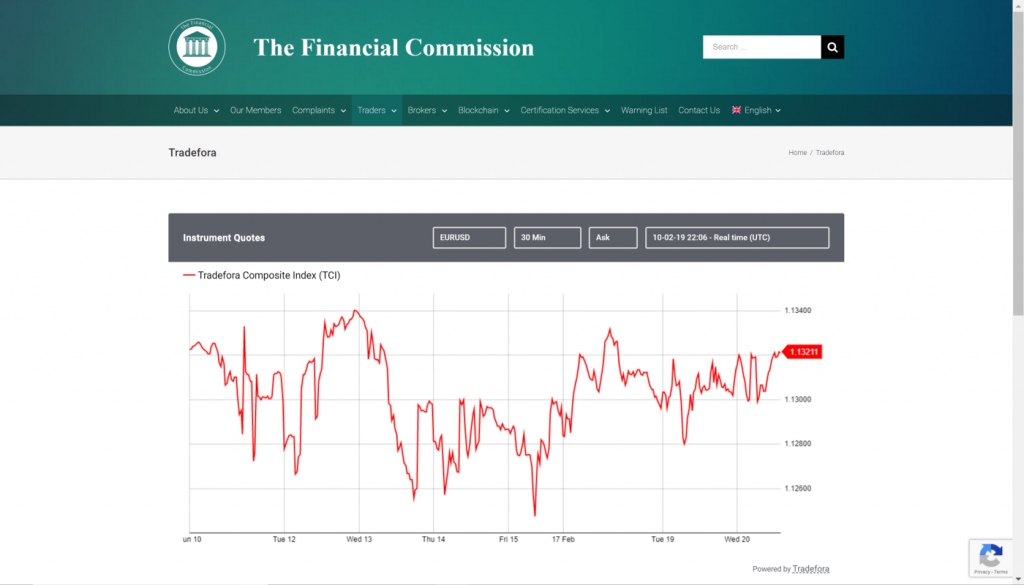

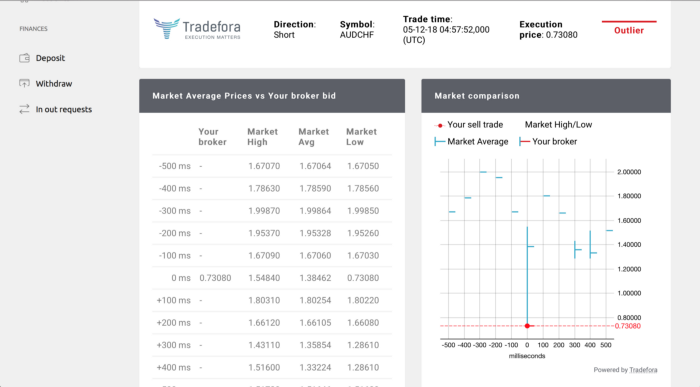

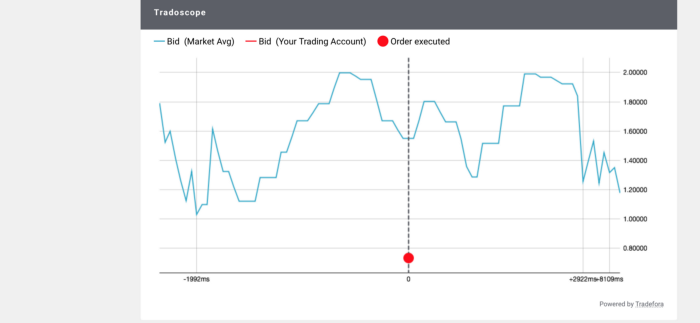

“Such implementation hurdles have served as a fertile ground for BestEx companies like Tradefora. Unlike some other vendors, who typically offer one institutional price feed as a benchmark of execution (e.g. Thomson Reuters or Bloomberg), Tradefora chose to go a different path and to compile its own institutional benchmark price feed. The idea is simple. As the vast majority of our clients are FX and CFD brokers servicing retail traders, when conducing best execution evaluation we want to be comparing apples to apples and oranges to oranges. Therefore, the actual execution is compared with the price feeds of those major LPs, which FX and CFD OTC brokers are most likely to use in their own liquidity pool.”

Pavel also added: “We are delighted to partner with Advanced Markets as one of the leading liquidity providers in the FX OTC space and a company that shares our drive for more market transparency. This partnership will enable us to further enhance our benchmark pricing tools across all the supported instruments with institutional level refresh rate frequency and full market depth analytics.

This marks an additional major development phase for us as we continue to aggregate top LPs to comprise a comprehensive institutional liquidity pricing index. Having a more robust reference price index will provide us with an ability to check not only the Top of the Book prices, but also to verify the VWAP execution quality across the entire market depth with millisecond precision”. Such flexibility becomes especially critical when performing trade validation for brokers with clients trading large ticket orders, as this would be crossing top of the book pricing.

“Advanced Markets is pleased to cooperate with Tradefora in this great mission of delivering crucial information on a broker’s quality of execution, and execution venues, benefiting both traders and regulators alike. Via this partnership, FX institutions can take advantage of Advanced Markets interbank liquidity feed, and Tradefora’s innovative RTS 27 reporting facility, along with other feed monitoring and benchmarking tools”, said Natalia Hunik, Global Head of Sales at Advanced Markets Group.

About Advanced Markets Group

Advanced Markets is a wholesale provider of liquidity, technology as well as credit solutions to institutional clients globally. This includes clients such as brokers, fund managers, hedge funds and CTAs (commodity trading advisors). The firm’s products support direct market access (DMA) trading in spot FX, energies, precious metals as well as CFDs (contracts for difference). All in global indices and also in commodities.

Through our extensive client base, we estimate that Advanced Markets liquidity ultimately serves more than 40,000 institutional and individual clients in more than 30 countries globally. Very Noteworthy: The company is privately held. Outside investors include Macquarie Americas Corp Inc., a wholly owned subsidiary of Macquarie Bank and BGC Partners.

For more information about Advanced Markets Group, please visit the company’s website: Advanced Markets Group